Technical support

How to order a Tax Clearance Certificate (Certificate of No Tax Arrears)

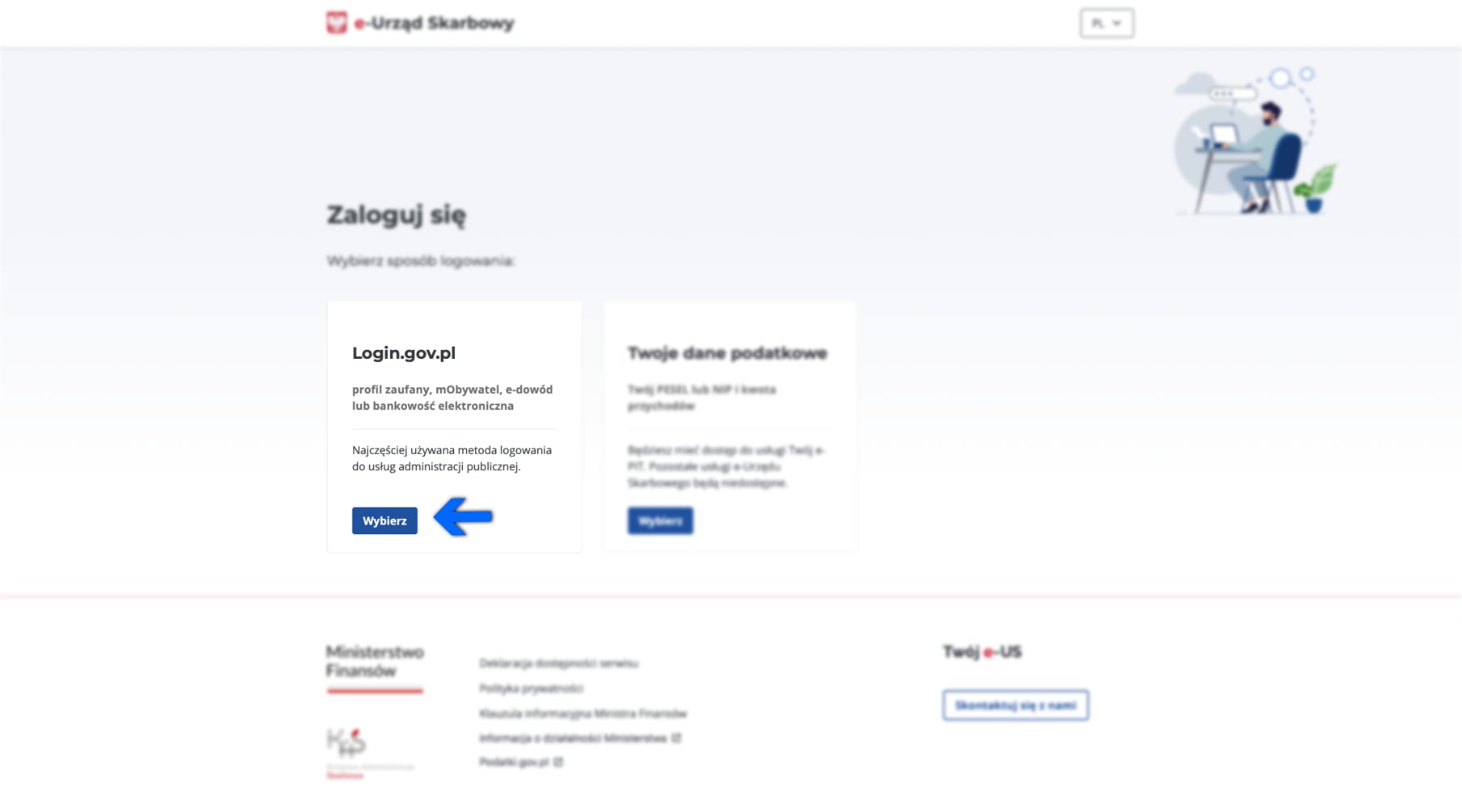

1. Go to the website www.podatki.gov.pl and select the e-Urząd Skarbowy section. Click «Zaloguj się do e-Urząd Skarbowy» (Log in to e-Urząd Skarbowy).

2. In the login methods section, click «Wybierz» (Select) next to Login.gov.pl.

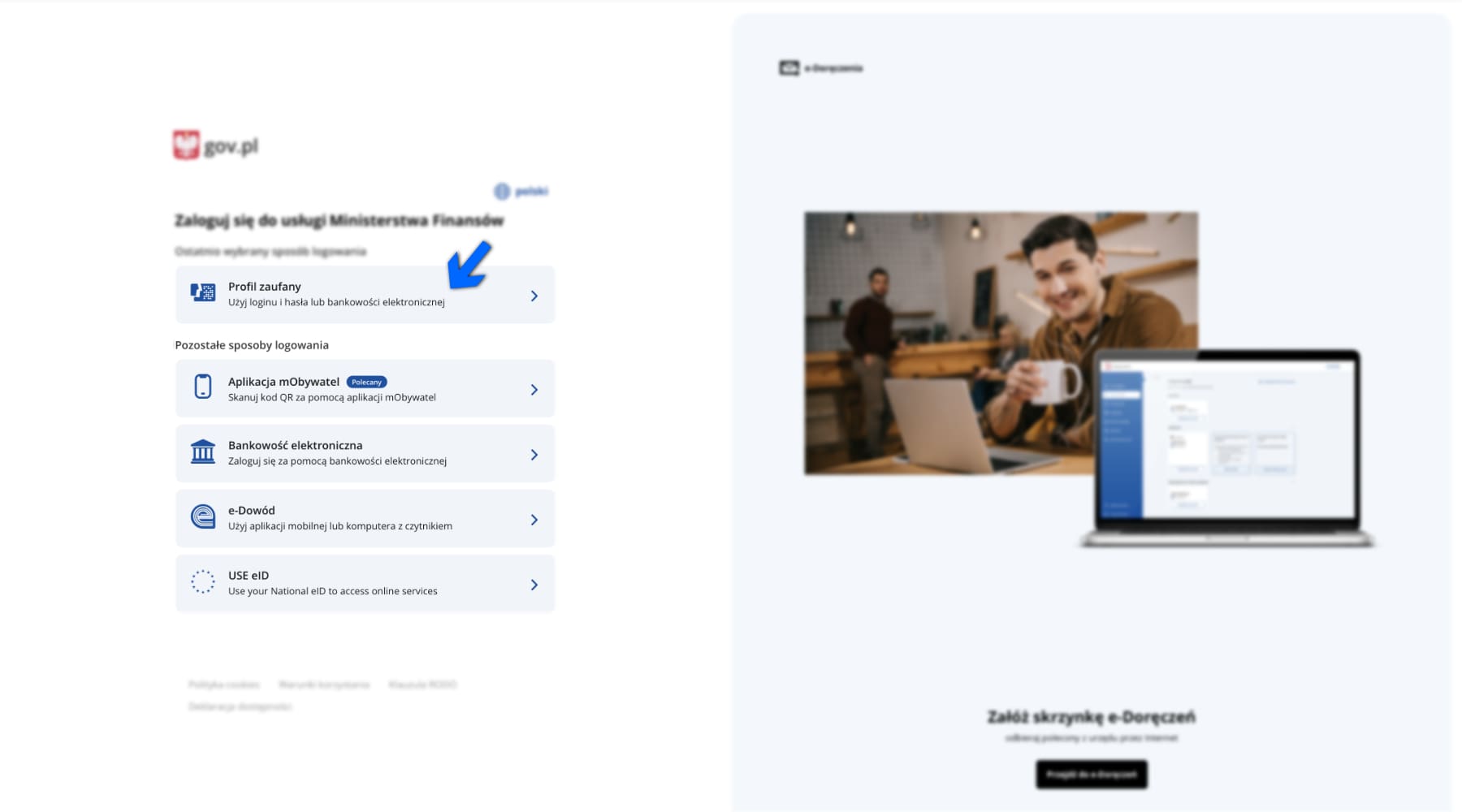

3. Log in using one of the available options, for example using Profil Zaufany (Trusted Profile).

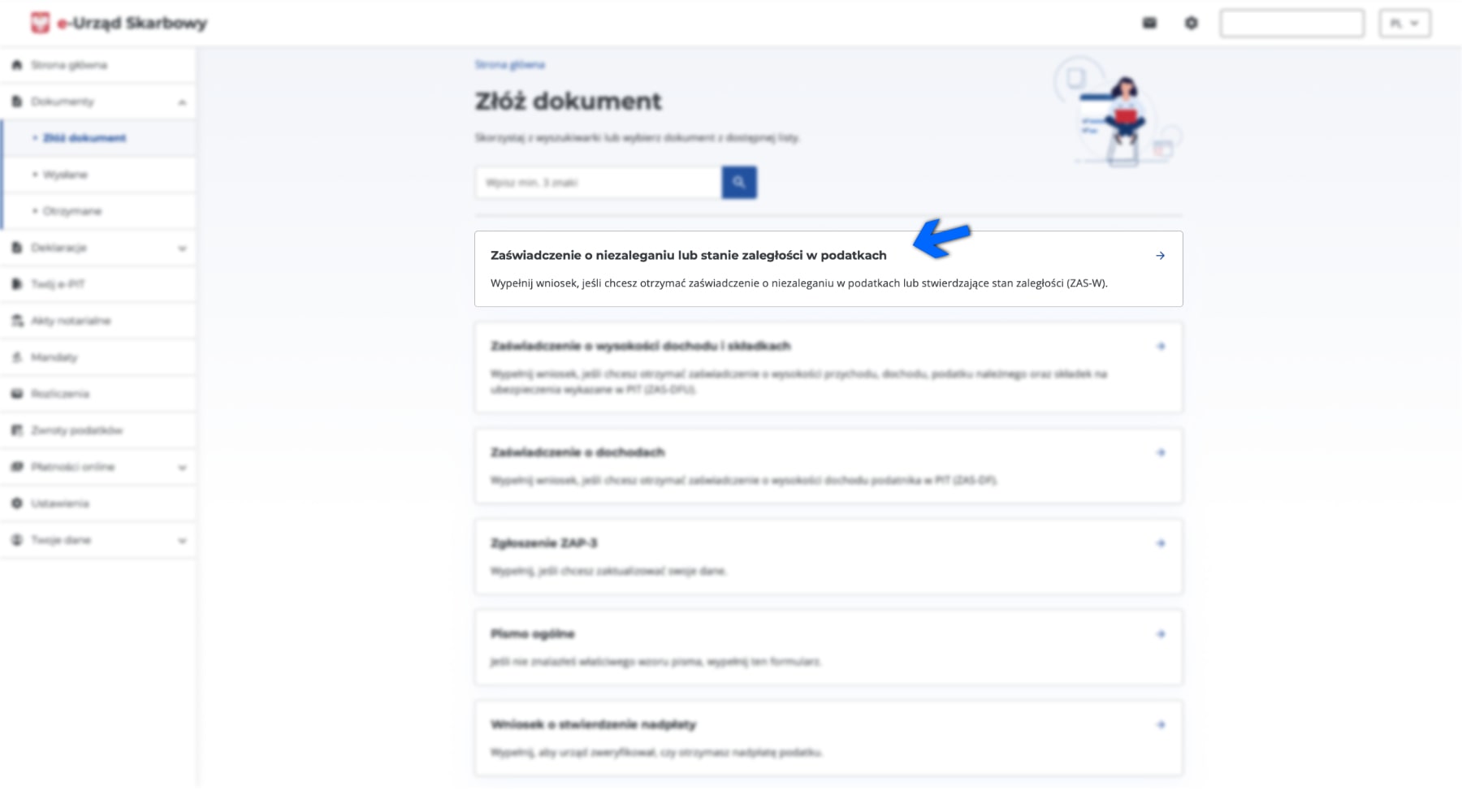

4. Go to the Złóż dokument (Submit document) panel and select Zaświadczenie o niezaleganiu lub stanie zaległości w podatkach (Certificate of no tax arrears or tax debt status).

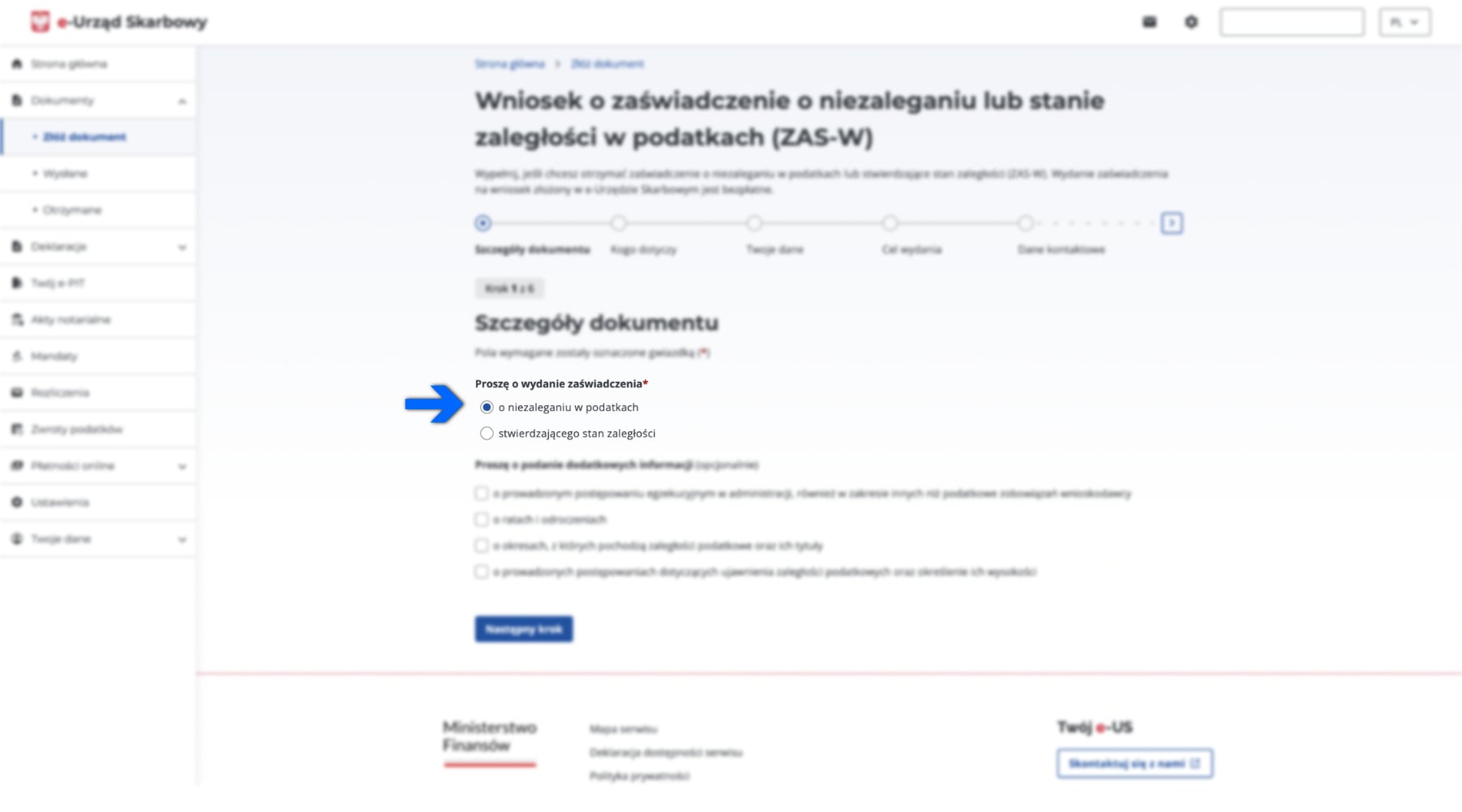

5. Select the type of certificate you wish to receive. You may also request to include additional information. Click Następny krok (Next step).

I request to issue a certificate: (required field):

- of no tax arrears

- confirming the existence of tax arrears

I request to include additional information (optional):

- about ongoing administrative proceedings not related to the applicant’s tax obligations

- about tax deferrals and payment in installments

- about the periods to which the tax arrears relate

- about proceedings to clarify the amount of the debt

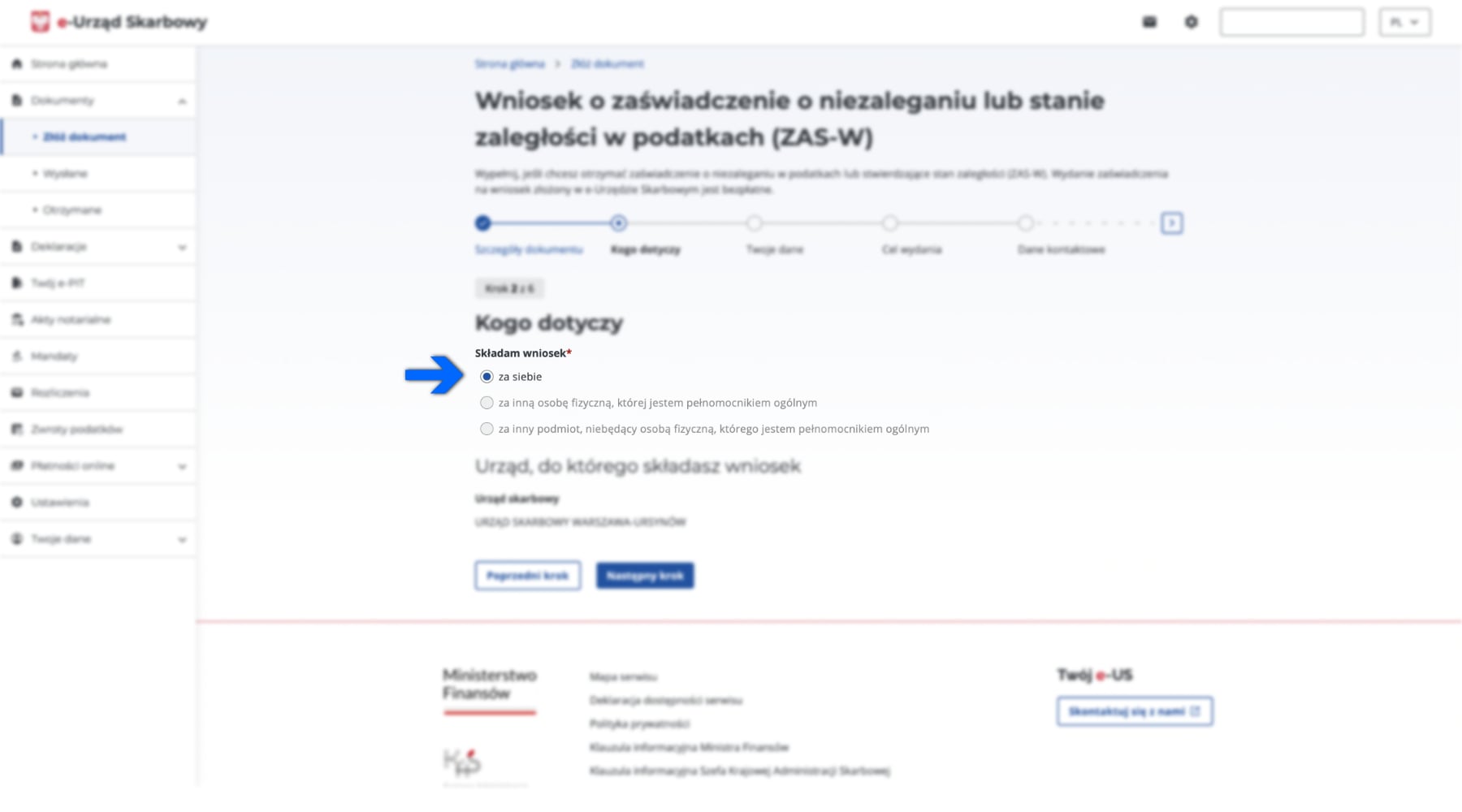

6. Select one of the following options:

- za siebie – for myself (if you are applying on your own behalf);

- za inną osobę fizyczną, której jestem pełnomocnikiem ogólnym – for another individual if you are their general representative;

- za inny podmiot, niebędący osobą fizyczną, którego jestem pełnomocnikiem ogólnym – for a legal entity (e.g., company) if you are their representative.

If applying for yourself, leave "za siebie" selected (default).

After choosing, click «Następny krok» (Next step).

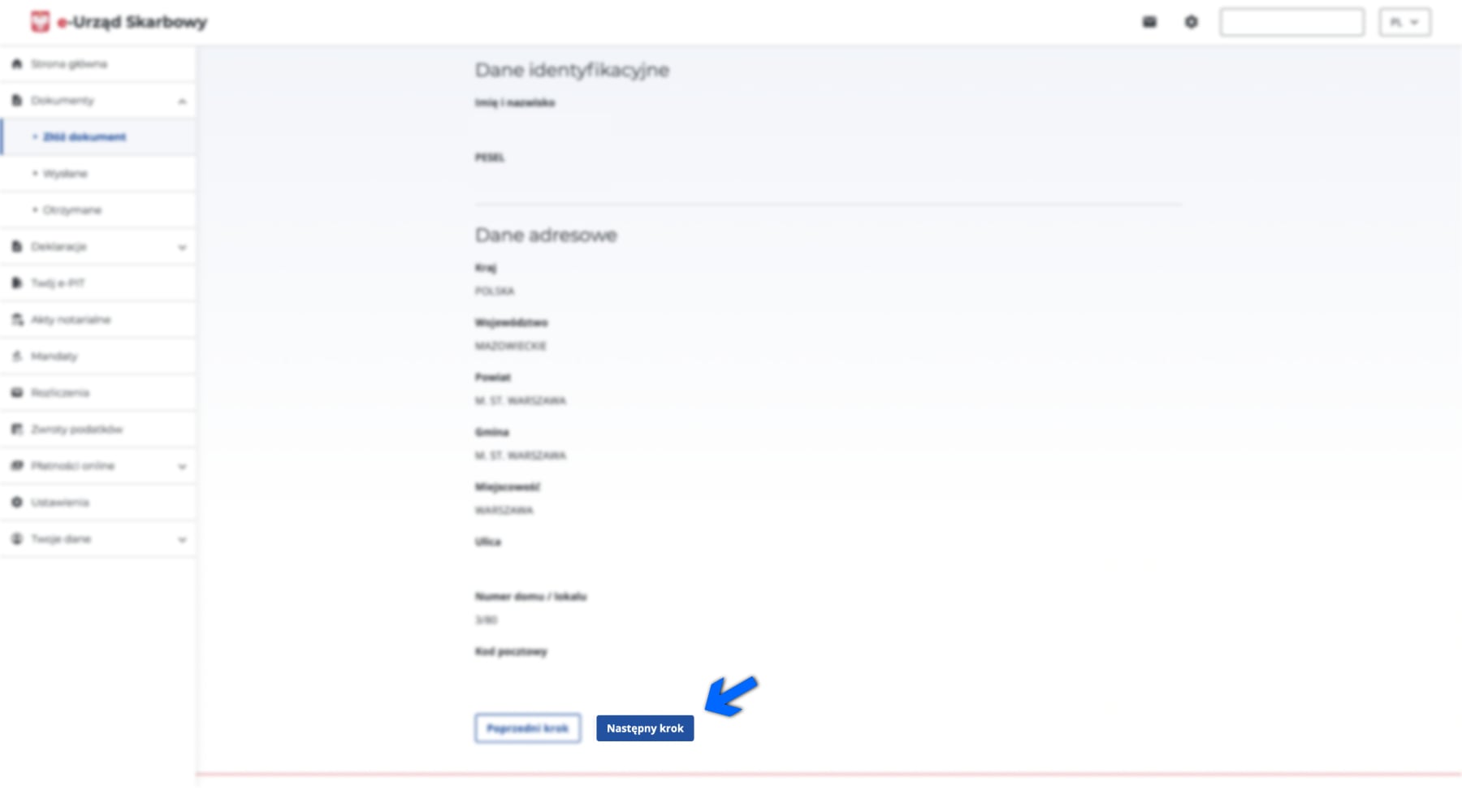

7. Verify your personal data. If any information is outdated or incorrect, go back to your profile and update the data before submitting the application. Click «Następny krok» (Next step).

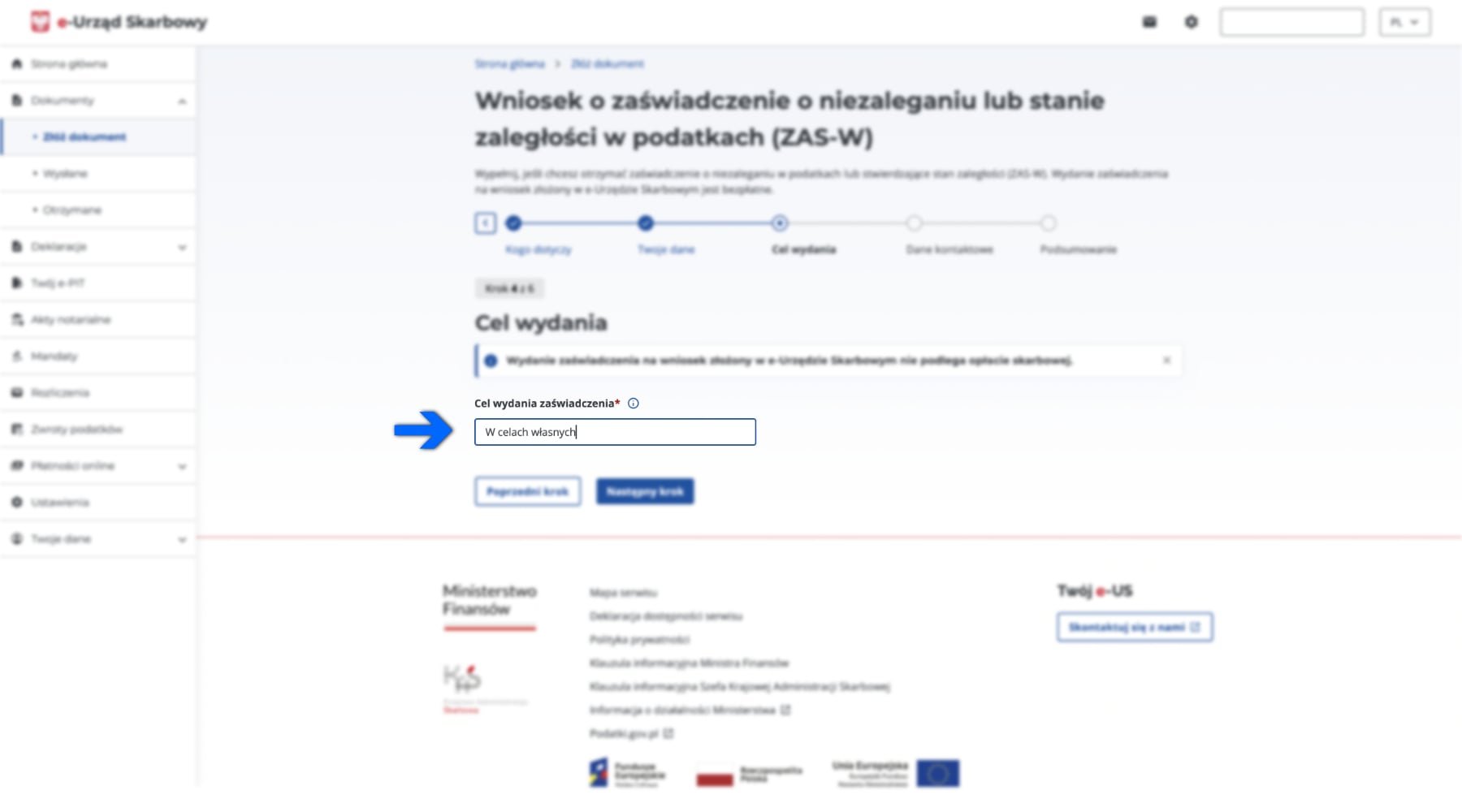

8. Specify the purpose for which the certificate is being requested. Examples:

- W celach własnych - For personal use

- Do banku – For the bank

- Do przetargu – For a public tender

- Dla kontrahenta - For a business partner

Click «Następny krok» (Next step).

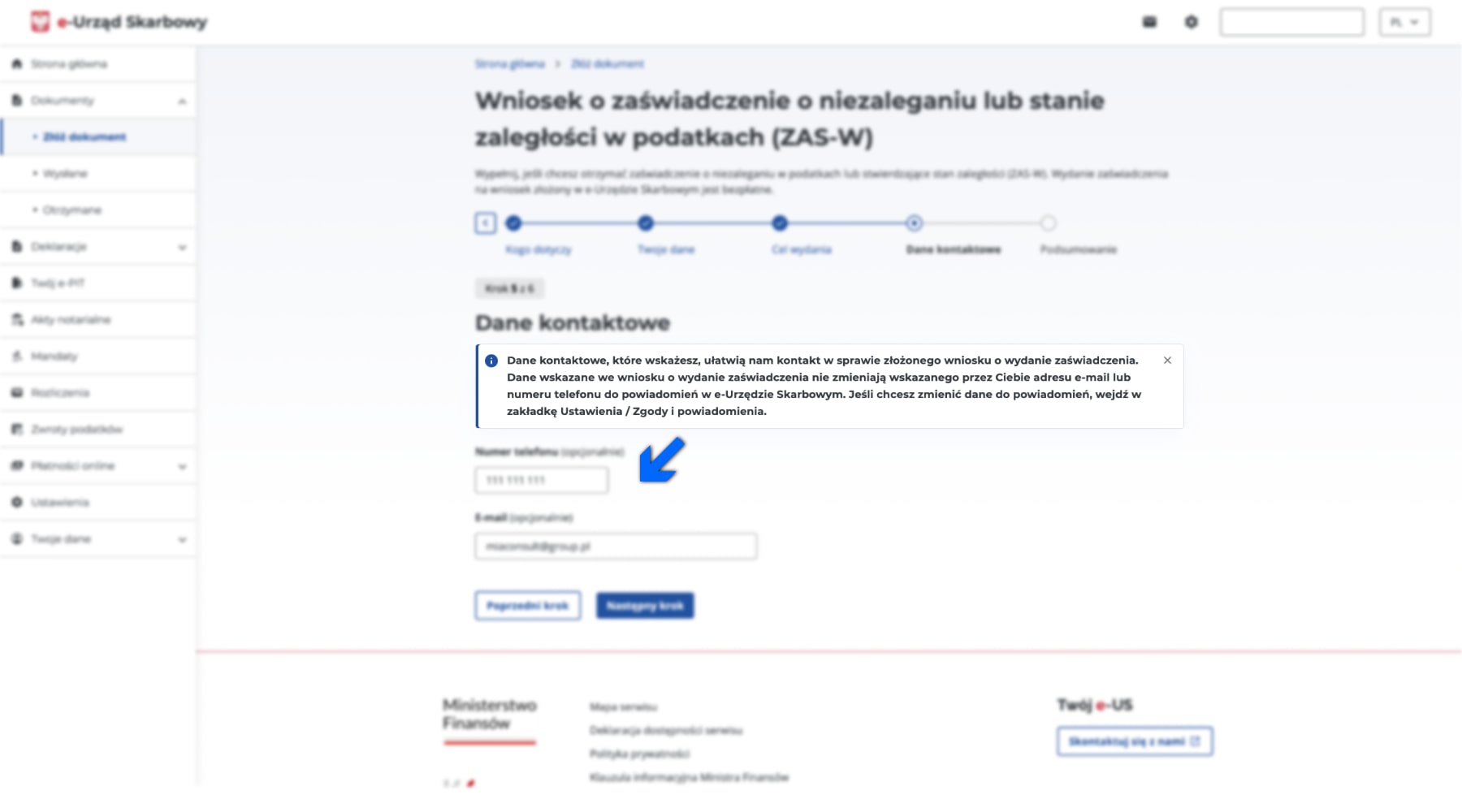

9. Optionally, provide your contact information so the tax office can reach you if needed. Click «Następny krok» (Next step).

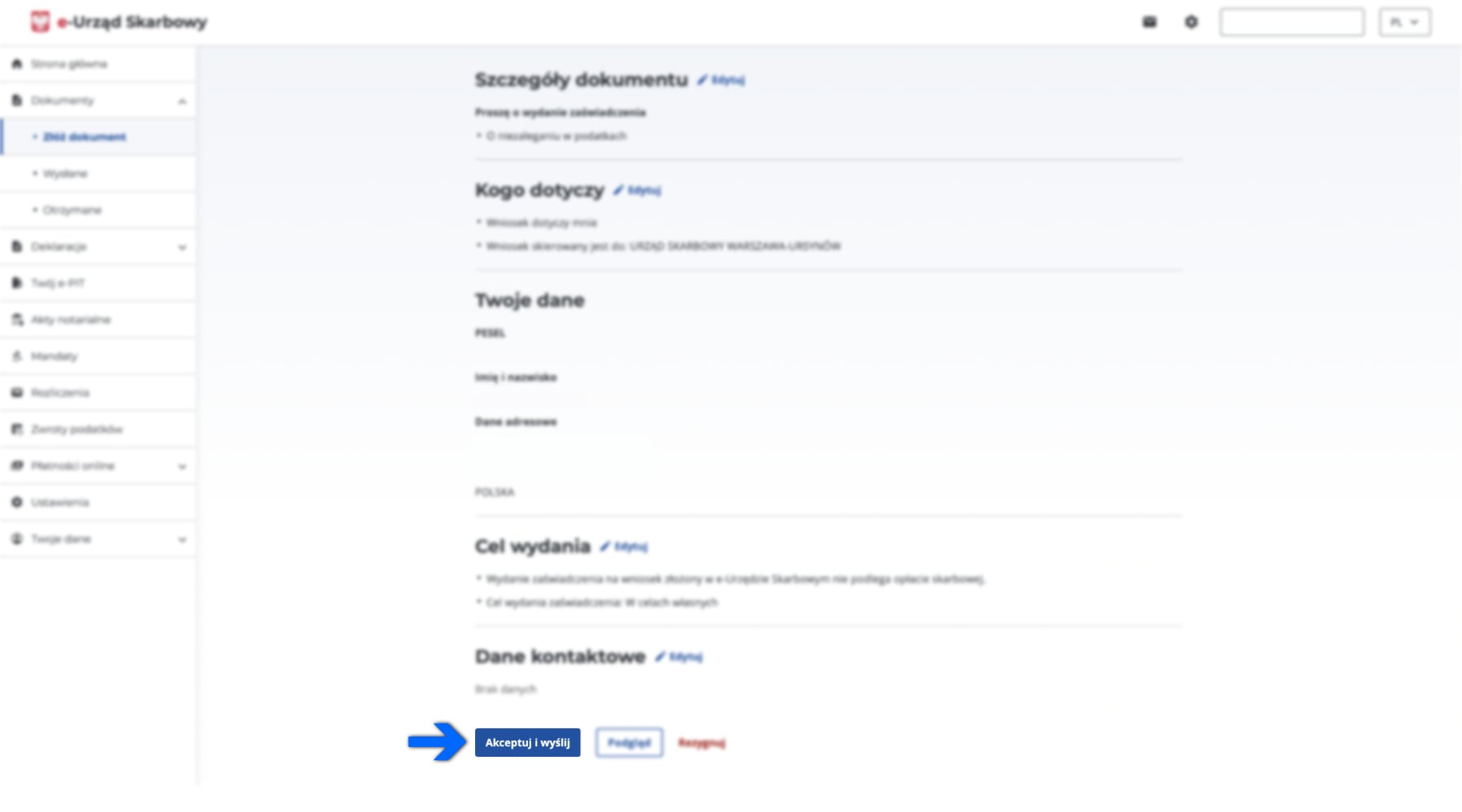

10. Review all the previously entered data and click Akceptuj i wyślij (Accept and send).

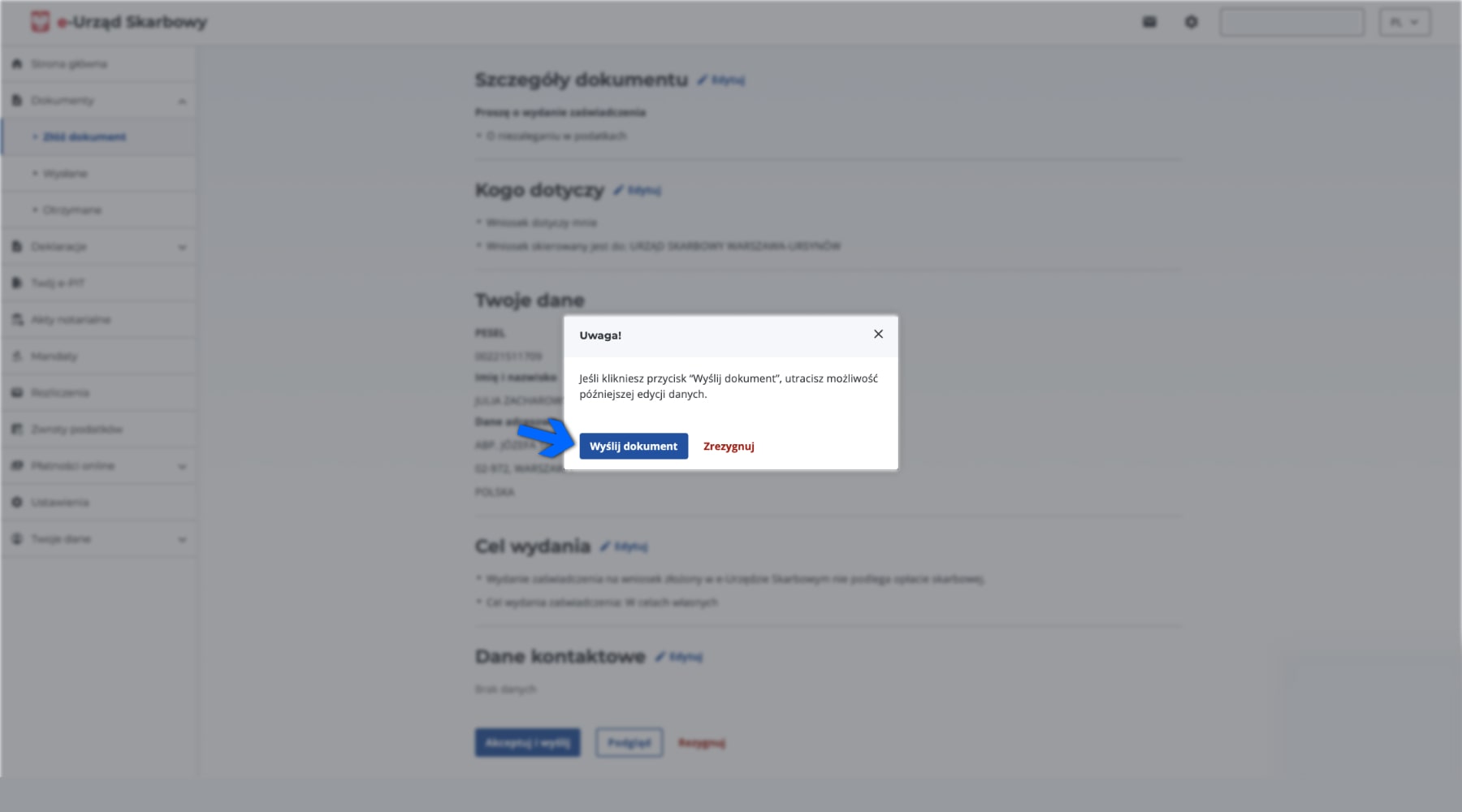

11. Click Wyślij dokument (Send document).

12. Done — your document has been sent. The certificate will be ready within 7 days. You will receive a notification once it is available.

OTHER QUESTIONS IN THIS CATEGORY

Even more convenient with the app

Sign in

Forgot your password?

Don’t have an account yet?

Sign up

Sign up

Gender:*

Male

Female

Complete verification

W ciągu 15 minut od rejestracji kod weryfikacyjny zostanie wysłany na podany

przez Ciebie

e-mail.

Forgot your password?

Change password

Enter the confirmation code received by e-mail and the new password.

Your request has been sent successfully

Our specialist will contact you during business hours

as soon as it is possible.